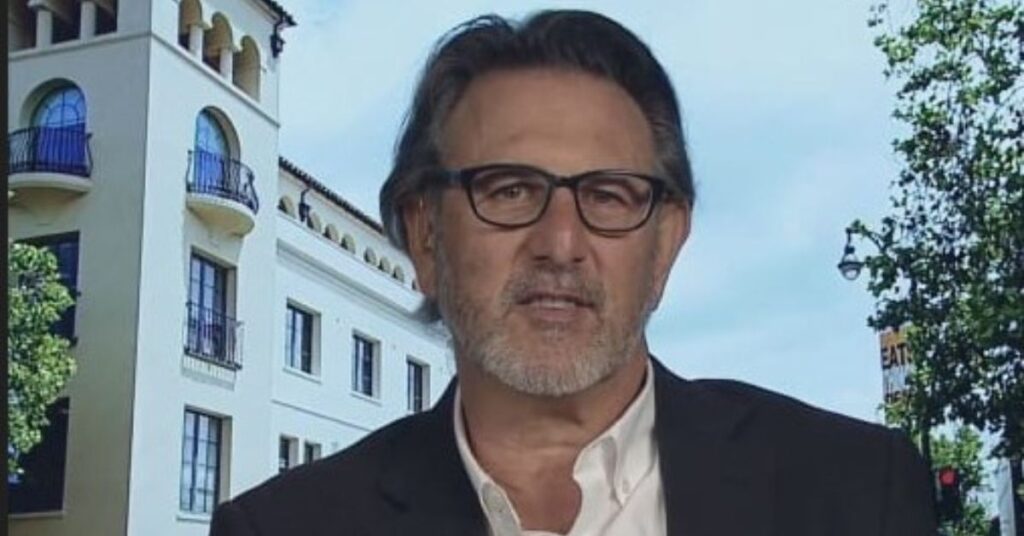

Fred Glick Real Estate Mortgage services are revolutionizing the way people approach real estate and mortgage transactions. Fred Glick is a prominent figure in the industry and is known for their innovative approach and client-centric services.

The services offered make home buying and mortgage processes more accessible and transparent. Ultimately, Fred Glick offers a one-stop solution for anyone interested in real estate or mortgage transactions in the United States.

This article will explore Fred Glick’s unique methods in real estate and mortgages, providing valuable insights and strategies for potential buyers, sellers, and investors.

Introduction To Fred Glick Real Estate Mortgage – His Real Exerties!

Fred Glick is a highly regarded real estate broker and mortgage specialist headquartered in the United States. Fred has decades of industry expertise and a strong reputation for providing open, efficient, and client-focused services.

They have experience in all aspects of real estate from residential and commercial transactions to mortgage finance and property management which enables them to deliver a comprehensive strategy that greatly benefits their customers. Fred’s knowledge has helped customers reach their real estate and financing objectives. Fre Glick’s professional highlights include:

- Extensive experience in real estate financing, brokerage, and property management.

- A commitment to improving the real estate process for everyone involved.

- Expanding services to help clients navigate complex real estate and mortgage markets.

Fred Glick’s Real Estate Philosophy – Transparency at Its Core!

Fred Glick’s passion for their customers distinguishes them from typical agents who are often commission-driven. The client-first approach guarantees that their customers get the greatest service available. Fred Glick has built a devoted clientele and gained worldwide respect in the real estate industry by emphasizing education and honesty,

To begin with Fred Glick believes in a straightforward, client-first approach to real estate. Their philosophy revolves around providing clear, honest information so clients can make informed decisions. Unlike many traditional real estate agents who prioritize their commissions, Fred offers a fixed fee real estate agents model.

What Makes Fred Glick Different:

- Transparency: Clear breakdowns of costs and services.

- Client-First Approach: Long-term relationships built on trust.

- Education: Clients understand every aspect of the process.

This philosophy has earned Fred a loyal client base and recognition as a leader in real estate and mortgage services.

Fred Glick Mortgage Features You Need to Know – Transparent, Fast, Reliable!

Fred Glick Real Estate Mortgage services focus on delivering the best mortgage options that are tailored to individual financial situations. By providing unbiased and personalized advice Fred takes the stress out of securing a mortgage.

They help clients understand their choices, explaining terms in a way that is easy to grasp, so there are no surprises down the line.

Competitive Mortgage Rates:

Fred Glick finds the best mortgage rates for his clients according to their financial situation. He works with a variety of lenders to ensure that his clients get the best competitive deals, which will save them money over the life of the loan.

Simplified Paperwork:

The mortgage process is often full of complex and time-consuming paperwork. Fred organizes, completes, and submits necessary documents, reducing the stress and confusion for clients

Personalized Guidance:

Fred offers impartial, one-to-one guidance in the mortgage process. From choosing the appropriate loan type to interpreting terms and conditions, Fred leaves no stone unturned to ensure clients are well-informed and confident at every turn.

Refinance Support:

If clients want to refinance their current mortgages, Fred is there to help them obtain a better rate or terms. This can save them money on their monthly payments or shorten the length of the loan.

Investment Property Mortgages:

Fred specializes in investment property mortgages, offering customized options for buyers looking for rental or commercial properties. He guides investors through the intricacies of financing to maximize returns.

The Services provided by Fred Glick includes – A Better Way to Buy or Sell Homes!

- Competitive Mortgage Rates and Terms: He helps clients secure the best possible rates and terms for their mortgages. This means shopping for competitive rates and finding a mortgage that fits the client’s budget and financial situation.

- Navigating Complex Paperwork: The mortgage process can involve a lot of complex paperwork, which can be overwhelming for clients. Fred assists in handling the paperwork, ensuring that everything is correctly completed and submitted, which reduces stress for clients.

- Expert Advice on Mortgage Options: Fred advises clients on the different types of mortgage products available, such as fixed-rate mortgages, adjustable-rate mortgages, and refinancing options. He explains the advantages and drawbacks of each option in simple terms, so clients can make informed decisions without confusion.

- Stress-Free Experience: Fred Glick’s main objective is to make the mortgage process as stress-free as possible. By providing clear and unbiased advice, Fred helps clients fully understand their choices.

- Dual Expertise in Real Estate and Mortgages: What sets Fred Glick apart is their dual expertise in both real estate and mortgage services. Usually, homebuyers need to work with a separate real estate agent and mortgage broker, which can complicate the process. Fred combines both roles allowing their clients to benefit from a seamless and coordinated service.

Read More: Lessinvest.Com Real Estate – Smart and Easy Property Investing!

Fred Glick’s Real Estate Trends – What Buyers and Sellers Must Know!

The real estate market is constantly evolving, and staying up-to-date on current trends is crucial for anyone looking to buy, sell or invest in property. Fred Glick offers valuable insights into the latest real estate market trends, helping clients make well-informed decisions.

Their understanding of both real estate and mortgage markets allows them to identify key trends and offer tailored advice to clients.

Current Real Estate Trends:

- Rising Home Prices: Increased demand and limited inventory have driven up home prices in cities like Denver.

- Competitive Market: Buyers should consider getting pre-approved for mortgages to have an edge.

- Interest Rate Fluctuations: Mortgage interest rates play a key role in determining housing affordability, and understanding these fluctuations can help clients make informed decisions.

- Economic Indicators: Understanding interest rates and economic trends is essential for making strategic investments.

Tips for Buyers and Sellers:

Buyers:

- Get pre-approved for a mortgage to enhance competitiveness.

- Understand your budget and stick to it to avoid financial stress.

- Research neighborhoods thoroughly before making a decision.

Sellers:

- Focus on staging and making minor upgrades to maximize property value.

- Work with a real estate expert to price the property correctly.

- Be flexible during negotiations to ensure a quick sale.

Investors:

- Stay updated on economic indicators to identify the best opportunities.

- Consider long-term trends for rental properties to maximize returns.

Fred Glick’s Insights on the Denver Market:

Fred Glick explains that the Denver real estate market is experiencing rising home prices due to high demand and a limited number of available homes. Which makes it challenging for buyers, especially first-time homebuyers. They should be prepared for competitive bidding wars where multiple offers might drive prices up.

Tools and Methods in Fred Glick’s Real Estate Services:

One of the most notable aspects of Fred Glick’s approach to real estate and mortgages is that they use innovation and technology. Fred Glick Real Estate Mortgage services are designed with the client in mind for using cutting-edge technology to improve efficiency and enhance the overall experience.

Fred Glick’s Real Estate Techniques:

Techniques that made Fred Glick popular all over the world.

- Fixed Fee Mode: Transparency in pricing without the traditional commission-based structure.

- Technology Integration: Digital mortgage applications and virtual property tours for added convenience.

- Data Analytics: Using data to predict market trends and make informed decisions.

- Virtual Consultations: Offering virtual consultations for clients who prefer remote interactions.

- Client Portals: Online platforms for clients to track their applications and transactions in real-time

Fred Glick’s Methods:

| Methods | Benefits |

| Fixed fee model | Cost predictability and affordability |

| Virtual tours | Convenience in property viewing |

| Data Analytics | Accurate, data-driven decision-making |

| Virtual consultations | Flexibility for clients who prefer remote interactions |

Must Read: Kennewick Comerc Real Estate – Build Your Future Today!

Benefits of Working with Fred Glick for Real Estate and Mortgages:

There are many reasons why clients choose Fred Glick Real Estate Mortgage services for their real estate and mortgage needs. One of the primary benefits is Fred’s dual expertise in both real estate and mortgages.

This combination allows clients to receive consistent and comprehensive guidance throughout the entire process without having to navigate between separate real estate agents and mortgage brokers.

Dual Expertise in Real Estate and Mortgages:

Fred Glick offers both real estate and mortgage services under one roof. This dual expertise means clients get consistent, comprehensive guidance throughout the entire process.

Instead of needing to work with separate real estate agents and mortgage brokers the clients can rely on Fred to manage all aspects seamlessly to make it much easier to buy or sell a home.

Transparent and Affordable Cost Savings:

Fred Glick’s fixed fee real estate agents model is a big advantage when it comes to saving costs. This ensures there are no surprises in terms of pricing, and clients know exactly what they are paying from the start.

This affordability and transparency make Fred’s services especially appealing for first-time homebuyers or anyone on a budget.

In-Depth Local Market Expertise:

Fred has deep knowledge of the Denver real estate market. This means he understands the local trends, neighborhoods, pricing, and economic factors that influence the real estate market in Denver.

Their insights are especially valuable for clients looking to buy or sell in Denver because they can provide customized advice based on what is currently happening in the area.

Must Read: Money6x.com Real Estate – All You Need To Know!

Fred Glick and Zillow Chatbot – Revolutionizing Mortgages for Homebuyers!

Fred Glick, a true leader in the real estate and mortgage realm, has partnered with Zillow’s remarkable chatbot to better the experience of financing a home. With this approach, convenience and transparency are elevated to the forefront, making the mortgage process faster, smarter, and pain-free for homebuyers.

When combined with Fred Glick’s personalized advice and industry expertise, homebuyers receive a seamless blend of technology and human support. This approach allows the best mortgage options, simple paperwork, and real-time updates directly to the comfort of their homes.

FAQs:

Why Fred Glick Prioritizes Client Experience in Real Estate?

Fred Glick is known for their personalized approach to real estate and mortgage services. Their client-centered philosophy is built on the belief that every client is unique and therefore deserves customized solutions that address their specific needs and goals.

Who makes more money, a real estate broker or a mortgage broker?

It depends on the job, location, and experience. Real Estate Brokers earn money when they sell properties and percentage of the sale price (around 2.5%-3%). Mortgage Brokers make money by helping people get loans and earn 1%-2% of the loan amount.

Do mortgage brokers work with real estate agents?

Yes! mortgage brokers often work with real estate agents. Real estate agents refer clients to mortgage brokers to secure financing for home purchases. This partnership ensures a smoother transaction process for the buyer.

Do mortgage brokers talk to agents?

Yes, mortgage brokers frequently communicate with real estate agents. They discuss client financing, timelines and documentation to align efforts and close transactions efficiently. This collaboration benefits both parties and ensures a seamless experience for the buyer.

How does Fred Glick make the mortgage process easier?

Fred Glick makes the mortgage process easier by simplifying complex steps and using online tools to keep everything organized to help clients feel informed and less stressed.

What makes Fred Glick’s real estate services unique?

Fred’s real estate services are unique because he combines financial expertise with personalized guidance by making each client feel understood and supported throughout the process.

What are Fred’s top tips for first-time homebuyers?

For first-time homebuyers, Fred advises setting a clear budget, getting pre-approved and being patient. They emphasize working with trusted professionals to make the journey smoother.

What is a real estate mortgage broker?

A real estate mortgage broker helps connect buyers with lenders and find the best loan options. They simplify the loan process by assisting with paperwork and negotiations.

What does contingent mean in real estate?

In real estate, “contingent” means a sale is pending certain conditions such as a home inspection or financing approval. If these aren’t met, the sale may not proceed.

How does Fred Glick’s fixed fee model work?

Fred’s fixed fee model charges a set fee for their services so clients know upfront what they’ll pay by making costs more predictable and often more affordable.

What innovative tools does Fred Glick use to enhance the client experience?

Fred uses innovative tools like online document sharing and tracking systems by allowing clients to stay updated and making the entire process easier and more transparent.

Conclusion:

Fred Glick Real Estate Mortgage services offer a unique combination of expertise, innovation, and client-focused solutions that are reshaping the real estate and mortgage industries. With the help of Fred Glick Real Estate Mortgage clients can navigate the complexities of real estate with confidence and ease.

Fred Glick is more than just a real estate broker and mortgage expert. Fred Glick Real Estate Mortgage is a partner in the journey toward achieving real estate goals. Whether you are a first-time homebuyer, a seller looking for the best deal, or an investor aiming to maximize returns Fred Glick’s approach is designed to provide value at every step of the way.

Read More:

- Brandon Miller Real Estate – From Success to $34M in Debt!

- California Department of Real Estate – Updates for Beginners!

- Pedro Vaz Paulo Real Estate Investment – Easy Ways to Build Wealth!