Investing in UK real estate transformed my financial future. The steady appreciation and rental income have provided unparalleled security.

Real estate investment UK offers a blend of stability and growth opportunities. From rental income to long-term appreciation, it’s a proven wealth-building strategy.

Stay tuned with us as we dive into the world of Real Estate Investment In The UK uncovering tips, strategies, and insights to make your journey successful!

Real Estate Investing For Beginners – Tips to Build Wealth!

Getting started in the UK property market can be both exciting and intimidating, especially for first-time investors. The good news is that Property Investment UK for beginners doesn’t have to be overly complicated.

Why Start with Property Investment in the UK?

- Low Barrier to Entry Options: If you’re wondering How to invest in property with little money, the UK offers beginner-friendly options like real estate crowdfunding, shared ownership schemes, and buy-to-let mortgages.

- High Demand for Housing: With a growing population and housing shortage, there’s always demand for rental properties in the UK, ensuring consistent returns.

- Tax Incentives and Financing: Beginner investors can benefit from tax deductions on mortgage interest and property management expenses. Which makes entry into the market less financially daunting.

Key Investment Strategies For Real Estate Investment UK – Maximize Profits!

Buy-To-Let Property Investment UK:

This is an investment technique through which the investors buy the property and rent it out. Buy-To-Let Property Investment UK can bring about a constant inflow of cash, particularly when the demand in the area is high.

In 2024, rentals in the UK rose by 9%. The demand remains pretty strong and promises to be a profitable avenue for buy-to-let investors.

Buy-to-Sell:

The investor buys a property to renovate and sell it for a profit. This is a very lucrative strategy if well executed, but it requires an understanding of market trends and property values.

Development Properties:

Investing in new developments or refurbishments can lead to significant capital appreciation, especially in areas undergoing regeneration24.

Real Estate Investment Trusts (REITs):

For the relatively passive investor, REITs are a good investment option, which allows the investor to buy real estate portfolios without owning any physical properties. REITs normally pay dividends and are less risky compared to direct property investments.

Read More: 3 Benefits of Upgrading Your AC Replacement

Steps to Start Property Investment in the UK – Essential Steps to Get Started!

- Familiarize the Market: Investors should know market hotspots and areas with promising rental yields. Some of these cities include Manchester, Liverpool, and Birmingham.

- Read reviews: For Real Estate Investment UK to familiarize yourself with market trends as well as reviews from other investors.

- Allocate a Budget: Determine your budget and additional costs such as stamp duty, legal fees, and property maintenance.

- Use Financing: Most beginners begin with a mortgage. There are competitive rates for buy-to-let mortgages. If money is scarce, explore creative ways to invest in property, such as How to invest in property with little money through joint ventures or shared ownership.

- Location, Location, Location: Invest in areas that have high rental demand and potential for growth. London is good for capital appreciation, while cities like Liverpool offer higher yields.

- Seek Experts: Partner with a property agent, solicitors, and mortgage broker to ensure a smooth transaction process.

- Know Legal and Tax Obligations: The novice investor should inform himself about property taxes, landlord regulations, and stamp duty to avoid shocks.

Best Cities In The UK For Property Investment – Top Picks!

Several cities in the UK stand out as prime locations for property investment due to factors such as regeneration projects, strong rental yields and population growth. Here’s a summary of the top cities to consider:

As of January 2025, the Investment Property UK for Sale presents various opportunities for investors looking to purchase investment properties. Here are some notable options and trends to consider:

| City | Projected Growth | Rental Yields | Population | Key Districts |

| Manchester | 15% by 2025 | 5%–9% | 553,230 (2021) | Salford Quays, Spinningfields |

| Birmingham | Boost from HS2, Big City Plan | 4%–6% | 1.15 million (2021) | Digbeth, Jewellery Quarter |

| Leeds | 39.56% over 5 years | 7.2% | 800,000+ | City Centre, Holbeck Urban Village |

| Liverpool | Ongoing developments | 7.4% | 496,784 (2021) | Baltic Triangle, Waterfront |

| Nottingham | 10.9% growth in coming years | 7.6% | 329,200 (2021) | City Centre, West Bridgford |

Read More: Kings Real Estate Reviews – An In-Depth Exploration!

Top 8 Companies Of 2025 – Best Real Estate Investment UK!

Real estate investment in the UK offers a wide range of opportunities, from direct property ownership to indirect investments through Real Estate Investment Trusts (REITs). If you’re seeking the best real estate investment UK options in 2025, this guide highlights top companies.

1. British Land:

British Land is one of the UK’s largest property development and investment companies, specializing in commercial and retail properties.

Key Features:

- Focuses on sustainable and flexible spaces.

- High-quality assets like shopping centers and office spaces in London and major cities.

Ideal For: Investors looking for long-term growth and sustainable development.

2. Landsec:

Landsec is a leading real estate company that manages retail, office, and mixed-use properties across the UK.

Key Features:

- Strong focus on London’s commercial real estate market.

- Implements ESG (Environmental, Social, Governance) principles in its developments.

- : Investors seeking exposure to London’s commercial property market.

3. Segro:

Specializing in industrial and logistics real estate, Segro is a top choice for investors looking to benefit from the growth of e-commerce.

Key Features:

- Owns warehouses, data centers, and logistics hubs.

- Robust performance was driven by rising demand for industrial spaces.

- Investors targeting high-growth sectors like logistics and technology.

4. Unite Students:

Overview: Unite Students is a prominent player in the student accommodation market, managing properties in key university cities.

Key Features:

- Operates in over 25 cities with high student populations.

- Provides purpose-built student accommodations with strong occupancy rates.

- Investors interested in stable rental income from student housing.

5. Grainger PLC:

Grainger is the UK’s largest listed residential landlord, focusing on build-to-rent properties.

Key Features:

- Specializes in high-demand areas like London, Bristol, and Manchester.

- Provides rental properties designed for professionals and families.

- Investors prioritizing residential rental income.

6. LendInvest:

LendInvest is a property finance platform offering loans and investment opportunities in UK real estate.

Key Features:

- Crowdfunding model for property investments.

- Provides access to short-term lending and property-backed securities.

- Beginners looking for a flexible and affordable entry into property investment.

7. Tritax Big Box REIT:

This Real Estate Investment Trust specializes in large-scale logistics properties.

Key Features:

- Long-term leases with blue-chip tenants like Amazon and Tesco.

- High demand for logistics spaces due to e-commerce growth.

- REIT investors seeking stable dividends and industrial property exposure.

8. Home REIT:

Home REIT focuses on providing housing solutions for the homeless, offering investors a chance to make a social impact.

Key Features:

- Long-term leases with local authorities and charities.

- Offers socially responsible investment opportunities.

- Impact investors looking for ethical and socially driven returns.

Real Estate Investment Trust UK – Easy Steps to Start Today!

Real Estate Investment Trusts (REITs) in the UK provide an efficient way for investors to gain exposure to real estate without the need for direct property ownership. Established in 2007 these REITs allow individuals and institutions to invest collectively in property portfolios.

Key Features of UK REITs:

| Key Feature | Details |

| Tax Efficiency | Exempt from corporation tax on rental income and capital gains if 90% of taxable income is distributed. |

| Diverse Investment Options | Offers residential, commercial, and industrial property investments to suit diverse risk profiles. |

| Accessibility | Over 50 REITs listed on the London Stock Exchange, accessible with low capital requirements. |

Read More: Real Estate Signs – Guide to Effective Property Marketing!

Benefits Of Investing In REITs In The UK – Easy and Profitable Property Investment!

Investing in Real Estate Investment Trusts (REITs) in the UK offers numerous advantages. It make an appealing option for both beginner and seasoned investors. One of the primary benefits is tax efficiency, as REITs are exempt from corporation tax on rental income and capital gains.

It provided they distribute at least 90% of their taxable income to shareholders. This structure allows investors to enjoy higher returns compared to traditional corporate investments.

REITs also provide diversified investment opportunities, giving access to various property types, including residential, commercial, and industrial sectors, enabling investors to tailor their portfolios to match their risk preferences and market conditions.

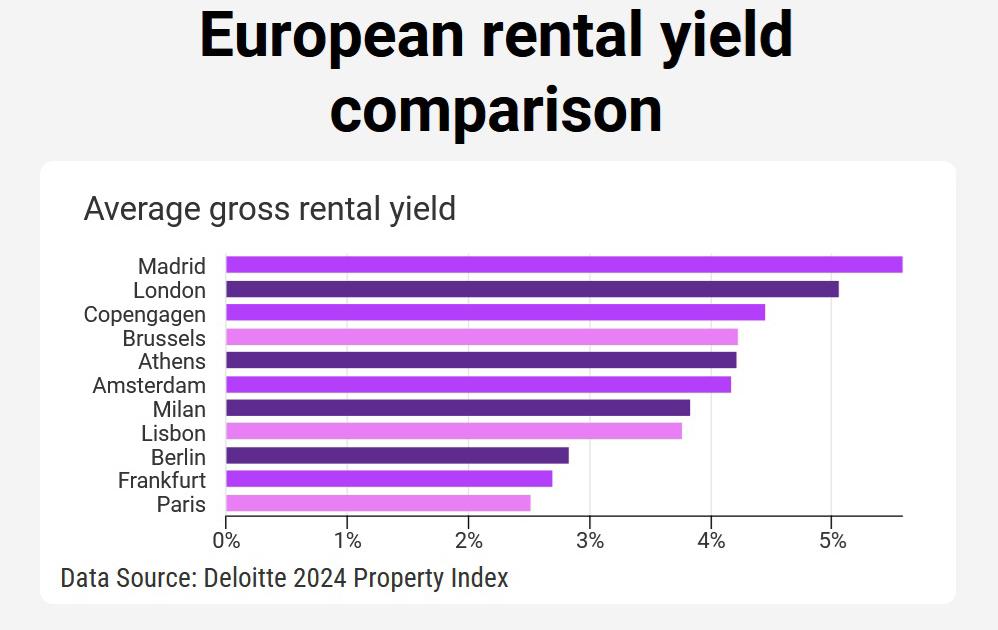

How does the rental yield in the UK compare to other European countries?

As of early 2025! the average rental yield in the UK is reported to be between 5% and 8%, with specific areas like Northern England achieving yields as high as 8.02%. In contrast, rental yields across various European countries show significant variation, influenced by local market conditions, property prices, and economic factors.

UK Rental Yield Overview:

The average rental yield in the UK is approximately 6.72% as of December 2024 with regions like the North East and Wales offering some of the highest yields at around 8%.

Regional Variations: Greater London typically exhibits lower yields (around 5.52%) due to high property prices relative to rental income.

Comparison with Other European Countries

Germany:

- Average Yield: Generally ranges from 3% to 5%, with cities like Berlin showing yields around 3.5% due to rising property prices and strong demand for rentals.

- Market Dynamics: The German market is characterized by long-term leases and tenant protections, which can stabilize rental income but limit yield potential.

France:

- Average Yield: Yields in major cities like Paris are typically around 3% to 4%, while smaller cities may offer yields closer to 5%.

- Investment Appeal: France’s real estate market is attractive for its stability, though high property costs in urban areas can suppress yields.

Spain:

- Average Yield: The rental yield in Spain varies widely, averaging between 5% and 7%, with popular tourist destinations like Barcelona and Madrid often yielding around 4% to 5%.

- Seasonal Factors: The tourism-driven market can lead to fluctuations in rental income based on seasonal demand.

Netherlands:

- Average Yield: Typically ranges from 4% to 6%, with Amsterdam yielding around 4.5%.

- Market Characteristics: The Dutch market is known for its strong rental demand and regulatory framework that supports tenant rights.

Italy:

- Average Yield: Generally between 4% and 6%, with cities like Milan and Rome often yielding around 4.5%.

- Investment Considerations: High property prices in major cities can limit yield potential compared to smaller towns.

Real Estate Investment UK Reviews – Learn from Real Experiences!

Whether you’re looking for residential, commercial, or industrial properties, the market offers attractive returns through rental income and capital appreciation.

Investors appreciate the yields in Manchester, Liverpool, and Birmingham cities which are at more than 6%-8%, which are pretty affordable compared to London. Capital growth remains the main appeal for long-term investors especially for those looking to invest with higher entry prices.

Options on real estate investment trust UK are also favored as they are very tax-efficient and accessible with good dividends that do not fluctuate much, perfect for a passive investor.

FAQs:

Is UK real estate a good investment?

Yes, investing in UK real estate is a smart choice. The market is stable, and there is always a high demand for homes. You can earn money through rent or by selling the property later for a higher price.

Can foreigners invest in UK real estate?

Yes, foreigners can buy property in the UK. There are no restrictions, but you may have to pay extra taxes, like the foreign buyer surcharge. It’s important to understand the rules before investing.

What is the safest investment with the highest return in the UK?

Buy-to-let properties in cities like Manchester, Birmingham, and Liverpool are safe and offer good returns. These cities have a high demand for rental homes and growing economies.

How can I invest in real estate in the UK?

To invest in UK real estate you have to decide your budget and goals. Research the market and choose a location. Get a mortgage or use your savings. Work with experts like property agents and solicitors. Then you can buy a property and manage it to earn rent or sell it later.

What are the key factors driving property price increases in the UK?

Property prices in the UK rise due to A growing population needing more homes and a Limited supply of houses. People moving to cities for work.

How To Invest In Property With Little Money?

Investing in property doesn’t always require a hefty sum. Invest in property with little money through crowdfunding platforms, Real Estate Investment Trusts (REITs) and shared ownership schemes.

How does the UK’s housing supply shortage impact property investment?

The shortage of homes increases demand, which pushes up property prices and rent. This is good for investors as they can earn more money, but it also means competition for buying homes is higher.

Conclusion:

Whether you’re exploring Property investment UK for beginners or strategizing as a seasoned investor; the UK real estate market offers tremendous opportunities. From Buy-to-let property investment UK to REITs and everything in between.

By leveraging options like How to invest in property with little money and focusing on high-yield areas. You can build a profitable portfolio in one of the world’s most dynamic property markets.

Must Read:

- Best Credit Card Points For Real Estate Investments – Maximize Savings!

- Pedro Vaz Paulo Real Estate Investment – Easy Ways to Build Wealth!

- Regency Real Estate – Top Relators of 2025!