Our Recent Projects

Investment

Investment

The Top Locations for Property Investment

Discover the best areas for property investment with high potential returns. Our guide helps you navigate the market to make smart, profitable decisions.

05 December 2022 Finance

Finance

Achieving Financial Independence through Real Estate

Explore practical strategies to attain financial independence through real estate. Learn about investment methods that build wealth and security for the future.

15 January 2022 Property

Property

Your Dream Home at the Best Rates: How to Calculate

Looking for your dream home? Discover essential tips on calculating mortgage rates and finding the best value to make your dream a reality.

21 December 2023Our Latest Blog Posts

- Understanding the Steps Involved in Vehicle RelocationRelocating a vehicle involves gathering relevant documents, choosing an auto shipping service, and scheduling. Leading vehicle relocation companies have… Read more: Understanding the Steps Involved in Vehicle Relocation

- Good Practices for Maintaining Your Home’s Exterior PaintProperly caring for exterior painting may boost curb appeal and protect your home’s surfaces from weather damage and environmental… Read more: Good Practices for Maintaining Your Home’s Exterior Paint

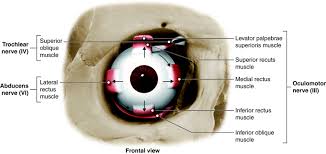

- Can Neurological Eye Issues Be Fixed?Neurological eye issues are conditions where visual problems arise due to disruptions in the way the brain and nervous… Read more: Can Neurological Eye Issues Be Fixed?

- The Role of Custom Stone Counters in Luxury Residential Construction TrendsStone counters are used in luxury residential construction due to their aesthetic appeal. Construction companies include these counters in… Read more: The Role of Custom Stone Counters in Luxury Residential Construction Trends

- How Interventional Radiology Reduces Risks in Liver Cancer TreatmentsLiver cancer often requires a combination of treatments tailored to each patient. Among the most promising approaches is interventional… Read more: How Interventional Radiology Reduces Risks in Liver Cancer Treatments

- What You Need To Know About DementiaDementia is a condition that affects millions of individuals and their families in the United States. It can influence… Read more: What You Need To Know About Dementia

- What to Look for When Choosing the Right Orthopedic Spine SurgeonAn orthopedic spine surgeon specializes in diagnosing and treating conditions related to the spine, including disorders like herniated discs,… Read more: What to Look for When Choosing the Right Orthopedic Spine Surgeon

- Techniques to Manage Anxiety in Everyday LifeAnxiety can impact various aspects of daily life, often making even simple tasks seem overwhelming. Incorporating practical strategies into… Read more: Techniques to Manage Anxiety in Everyday Life

- The Benefits of Seeing a Cardiologist for Regular Heart MonitoringMaintaining heart health is a key part of overall well-being. Regular heart monitoring with a cardiologist can help identify… Read more: The Benefits of Seeing a Cardiologist for Regular Heart Monitoring

- Understanding c896a92d919f46e2833e9eb159e526afIn the digital age, strings of characters like c896a92d919f46e2833e9eb159e526af might seem cryptic at first glance. However, these strings play… Read more: Understanding c896a92d919f46e2833e9eb159e526af

- Understanding Robocalls The Case of 3312909366In the digital age, the influx of calls from unknown numbers has become a significant concern. One such number,… Read more: Understanding Robocalls The Case of 3312909366

- Understanding the LTPK012AB0403 Fiber Optic CableIn today’s interconnected world, the demand for robust and versatile communication infrastructure is paramount. The LTPK012AB0403 fiber optic cable… Read more: Understanding the LTPK012AB0403 Fiber Optic Cable

- information of gf qiuyakghmiz companyGeorg Fischer (GF) is a prominent Swiss-based industrial corporation with a rich history spanning over two centuries. Renowned for… Read more: information of gf qiuyakghmiz company

- is qell094x-fv2 model good where to find fuixicnos74 modelIn the world of technology and advanced systems, the names of specific models can often be confusing. If you’ve… Read more: is qell094x-fv2 model good where to find fuixicnos74 model

- is tempeh a food analogFood alternatives and analogs have gained traction as plant-based diets become more popular. One such product is tempeh—a fermented… Read more: is tempeh a food analog

- https://finanzasdomesticas.com/mexico-tendra-el-mercado-mas-grande-de-cannabisMexico is set to achieve a historic milestone by establishing the largest legal cannabis market globally. This significant move… Read more: https://finanzasdomesticas.com/mexico-tendra-el-mercado-mas-grande-de-cannabis

- https://jurisfera.com/plazo-para-reclamar-por-negligencia-abogado/When seeking legal help, clients place a significant amount of trust in their attorneys to handle their cases with… Read more: https://jurisfera.com/plazo-para-reclamar-por-negligencia-abogado/

- is fojatosgarto hard to cookCooking can be a rewarding yet challenging endeavor, and when it comes to unusual dishes or unfamiliar names, the… Read more: is fojatosgarto hard to cook

- http error 500.30 – asp.net core app failed to startWhen you deploy an ASP.NET Core application and encounter the error message “HTTP Error 500.30 – ASP.NET Core app… Read more: http error 500.30 – asp.net core app failed to start

- http 192.168 33.1If you’ve ever needed to configure a router, modem, or other network devices, you might have come across the… Read more: http 192.168 33.1

- http 10.10 100.254In the realm of networking, one of the most essential elements is the ability to configure and access network… Read more: http 10.10 100.254

- http //fritz.box – The Ultimate Guide to Accessing and UnderstandingIn today’s connected world, managing home networks and internet routers has become a fundamental skill. If you own a… Read more: http //fritz.box – The Ultimate Guide to Accessing and Understanding

- alexandre reant piege a moustiqueLes moustiques, ces insectes volants souvent synonymes de nuisances estivales, sont responsables de nombreuses piqûres et peuvent transmettre diverses… Read more: alexandre reant piege a moustique

- TechStudify.com – Simplifying the World of Technology 2025In today’s rapidly evolving digital landscape, staying abreast of technological advancements can be both exciting and overwhelming. TechStudify.com emerges… Read more: TechStudify.com – Simplifying the World of Technology 2025

- does Noodlemagazine take against piracy and copyright violations?Introduction In the digital age, online platforms have become central to how we consume and share content. Among these… Read more: does Noodlemagazine take against piracy and copyright violations?

- A Comprehensive Guide imagesize:地藏王菩薩 1920×1080Introduction In the vast pantheon of Buddhist deities, one figure stands out for his deep compassion, unwavering vow to… Read more: A Comprehensive Guide imagesize:地藏王菩薩 1920×1080

- what cilfqtacmitd help with – Streamlining Medical Team Deployment in Global HealthcareIntroduction Medical professionals often rely on abbreviations to simplify complex processes and improve communication efficiency. One such acronym, what… Read more: what cilfqtacmitd help with – Streamlining Medical Team Deployment in Global Healthcare

- https://api-takumi.mihoyo.com/event/download_porter/time_linkIn the world of gaming and digital content, APIs (Application Programming Interfaces) play a crucial role in delivering seamless… Read more: https://api-takumi.mihoyo.com/event/download_porter/time_link

- Unlocking the Power of https://zharezhade.org – A Comprehensive GuideIn today’s digital world, accessibility, efficiency, and convenience are more important than ever. As we constantly seek ways to… Read more: Unlocking the Power of https://zharezhade.org – A Comprehensive Guide

- Discover the Power of http://bit.ly/47rilyv – A Digital Innovation Changing the GameIn the fast-paced world of digital tools and resources, the ability to access and share information efficiently is paramount.… Read more: Discover the Power of http://bit.ly/47rilyv – A Digital Innovation Changing the Game

- Top Property Presentation Techniques to Sell Home Faster!When it comes to selling real estate, first impressions matter dramatically. Whether you’re selling a cozy home or a… Read more: Top Property Presentation Techniques to Sell Home Faster!

- Space Real Estate – Final Frontier Of Property Investment!I see immense potential in owning land on the Moon or Mars, offering a unique investment opportunity. In the… Read more: Space Real Estate – Final Frontier Of Property Investment!

- 7 Proven Benefits of Real Estate Drone Photography!Real Estate Drone Photography has revolutionized the way properties are marketed. Whether you’re a real estate agent, property developer,… Read more: 7 Proven Benefits of Real Estate Drone Photography!

- https : //seeeddoc.github.io/kkmulticontroller/res/kkmulticontroller_v5.5.pdfKKMulticontroller V5.5 is a popular flight control board designed for hobbyists and professionals who want precise drone stabilization. Whether… Read more: https : //seeeddoc.github.io/kkmulticontroller/res/kkmulticontroller_v5.5.pdf

- https //www.myhub.ahealthmarketplace.com loginManaging healthcare benefits efficiently is essential in today’s fast-paced world. https //www.myhub.ahealthmarketplace.com login provides users with a seamless way… Read more: https //www.myhub.ahealthmarketplace.com login

- https //mega.nz/file aym0xdjlIn today’s digital world, secure file sharing is crucial for businesses, professionals, and individuals alike. One of the best… Read more: https //mega.nz/file aym0xdjl

- https //coomer.su lactating jioLactation is a natural and essential process that provides newborns with the best source of nutrition—breast milk. However, many… Read more: https //coomer.su lactating jio

- https://m.ok.ru/cdk/st.cmd an american in austinAustin, Texas, stands as a vibrant testament to American diversity and innovation. Known for its eclectic music scene, rich… Read more: https://m.ok.ru/cdk/st.cmd an american in austin

- What Is First Td In Real Estate – Key Concepts Explained!Understanding financial instruments is crucial for both buyers and investors. One such instrument is the first trust deed (First… Read more: What Is First Td In Real Estate – Key Concepts Explained!

- What Does Active Mean On Zillow?Navigating the world of real estate can often be a confusing experience, especially when dealing with terms and statuses… Read more: What Does Active Mean On Zillow?

- https://quesonlosvaloreseticos.com/definicion-de-creatividadCreativity is the ability to generate new ideas, concepts, and solutions that are original and valuable. It plays a… Read more: https://quesonlosvaloreseticos.com/definicion-de-creatividad

- https://guia-automovil.com/2020/10/07/los-3-mejores-autos-clasicos-de-fordFord has long been synonymous with innovation in the automotive industry. From mass production to revolutionary designs, Ford’s history… Read more: https://guia-automovil.com/2020/10/07/los-3-mejores-autos-clasicos-de-ford

- How To Use LOI Template For Real Estate Purchase In Nevada?A Letter of Intent (LOI) is an important first step in the real estate transaction process. Though it’s typically… Read more: How To Use LOI Template For Real Estate Purchase In Nevada?

- Allegheny Real Estate Portal – Access Property & Tax Details!The Allegheny Real Estate Portal is an essential tool for individuals interested in accessing property information in Allegheny County,… Read more: Allegheny Real Estate Portal – Access Property & Tax Details!

- Lessinvest.Com Real Estate – 2025’s Best Investment Option!Would you like to invest in real estate but seems too technical? Then, LessInvest.com Real Estate is the best… Read more: Lessinvest.Com Real Estate – 2025’s Best Investment Option!

- Pedro Vaz Paulo Real Estate Investment – Top Choice for 2025!Have you ever wondered how some real estate investors achieve lasting success? Pedro Vaz Paulo Real Estate Investment stands… Read more: Pedro Vaz Paulo Real Estate Investment – Top Choice for 2025!

- Money6x.com Real Estate – Best USA Property Dealer of 2025!Money6x.com real estate transformed my property investment. Highly recommended to anyone looking forward to establishing and growing their real… Read more: Money6x.com Real Estate – Best USA Property Dealer of 2025!

- Invest1now.com Real Estate – Smarter Investment Of 2025!Are you looking for an easier way to invest in real estate? Invest1now.com real estate is here to simplify… Read more: Invest1now.com Real Estate – Smarter Investment Of 2025!

- Homes For Sale Southwest Ranches Www.Scottschneidergroup.Com 2025!Finding our dream home in Southwest Ranches was seamless with the Scott Schneider Group. Their expertise and personalized service… Read more: Homes For Sale Southwest Ranches Www.Scottschneidergroup.Com 2025!

- Biitland.com Digital Assets In 2025 – Future of Crypto!Biitland.com Digital Assets have emerged as a revolutionary force in modern finance. These blockchain-powered assets offer secure, decentralized, and… Read more: Biitland.com Digital Assets In 2025 – Future of Crypto!

Our Latest Tags

2178848983 2675260370 3312909366 4699156172 Bermuda Real Estate c896a92d919f46e2833e9eb159e526af cleveland guardians vs phillies match player stats Essentiel B KM 10 SF Programme homes for sale southwest ranches www.scottschneidergroup.com How To Get A Real Estate License Uk https://bit.ly/3yjcth1 https://fotise.com/cuanto-seguro-de-vida-necesito https://hotdogtix.com/[test]活動 https://ibb.co/gw0j9xx https://link.springer.com/article/10.1007/s10489-024-05479-x https://noticviralweb.blogspot.com/2024/04/erp.html http status ohne text gefährlich invest1now.com invest1now.com best investments invest1now.com real estate lessinvest.com less invest.com lessinvest.com real estate money6x.com money6x.com real estate Money6x.Com Save Money money6x real estate Myfastbroker Mortgage Brokers online appointments lessinvest.com real estate Pavilion Real Estate Pavilion Real Estate – Top Properties for Sale and Rent! pdpk012ab3010 pedrovazpaulo real estate investment pedro vaz paulo real estate investment pedrovazpaulo stocks investment pedrovazpaulo wealth investment Redian Real Estate rock paper scissors yellow dress Saudi Real Estate Www.Scottschneidergroup.Com